Life Insurance & Living Benefits for Everyone

Life Insurance & Living Benefits for Everyone

What is life insurance ?

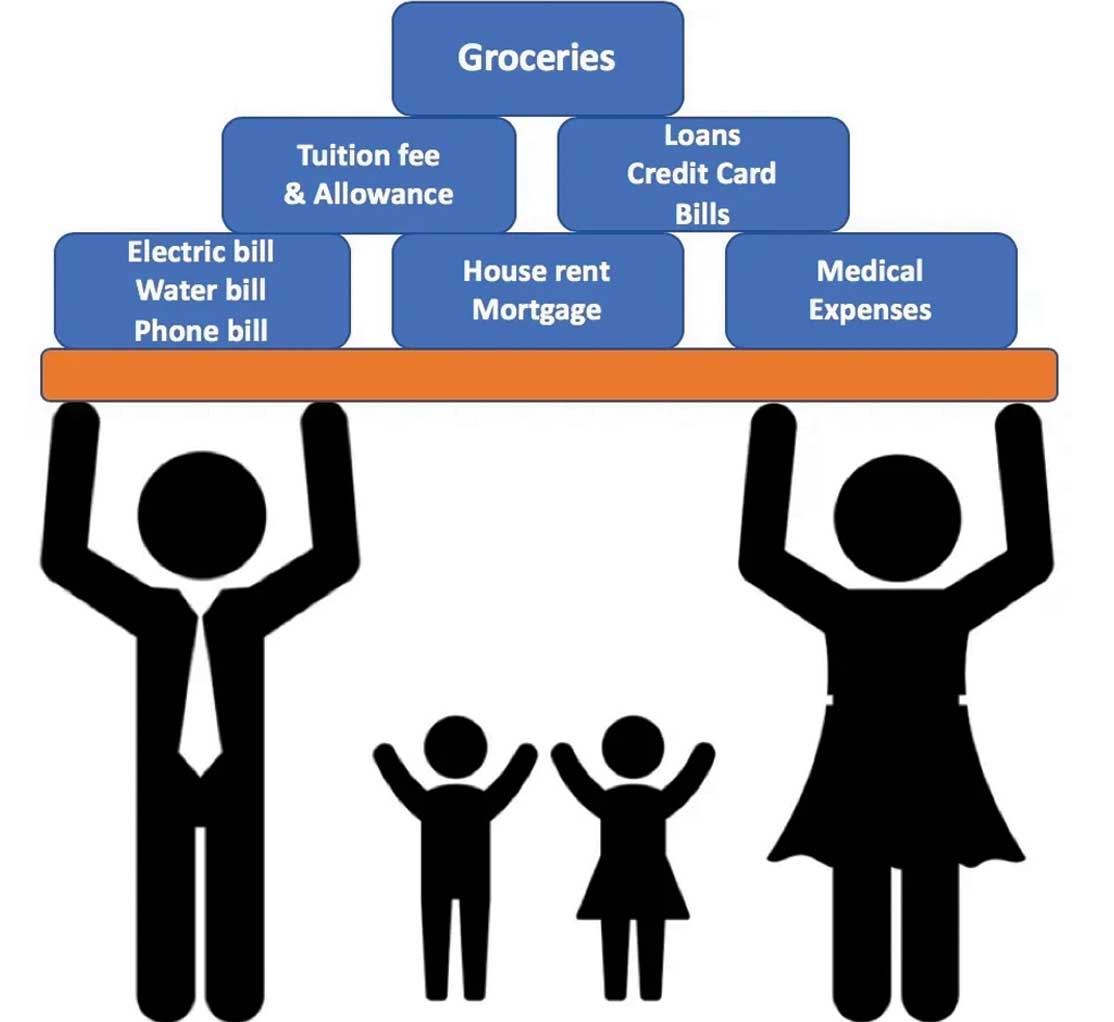

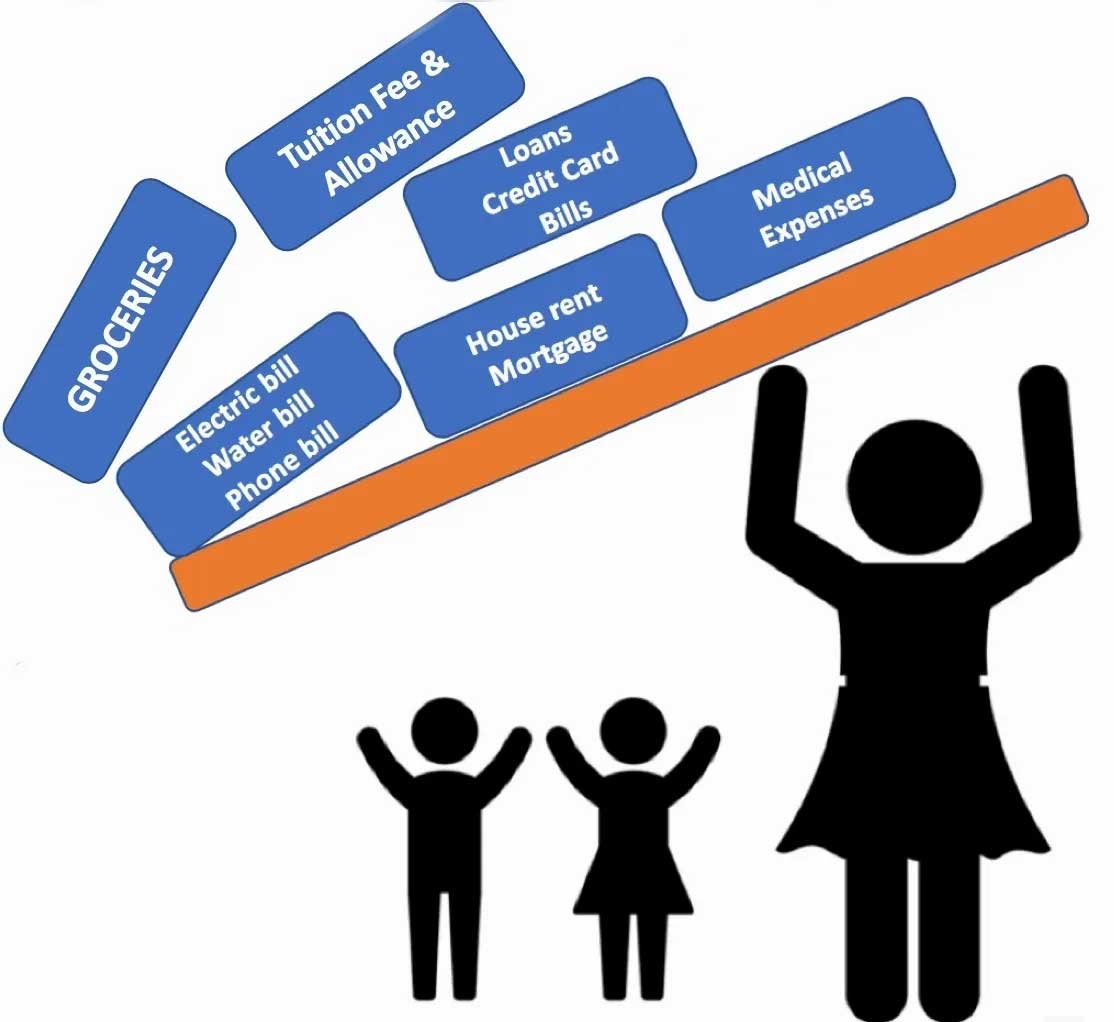

Life insurance protects families and businesses from financial loss associated with the death of a loved one or key employee and as a financial tool for retirement planning. Life insurance enables individuals and families of all income brackets and lifestyles to maintain financial independence in the face of financial hardships.

Coverage is just as important for two-income families as it is for single-income families. Stay-at-home parents also need protection to help cover the costs of services they routinely provide, such as cooking, cleaning, and caring for children. Retirees who are living on limited income also find peace of mind knowing that an aging spouse will not be faced with a financial burden after their death.

Love Insurance ?

What is life insurance ?

Life insurance protects families and businesses from financial loss associated with the death of a loved one or key employee and as a financial tool for retirement planning. Life insurance enables individuals and families of all income brackets and lifestyles to maintain financial independence in the face of financial hardships.

Coverage is just as important for two-income families as it is for single-income families. Stay-at-home parents also need protection to help cover the costs of services they routinely provide, such as cooking, cleaning, and caring for children. Retirees who are living on limited income also find peace of mind knowing that an aging spouse will not be faced with a financial burden after their death.

Love Insurance ?

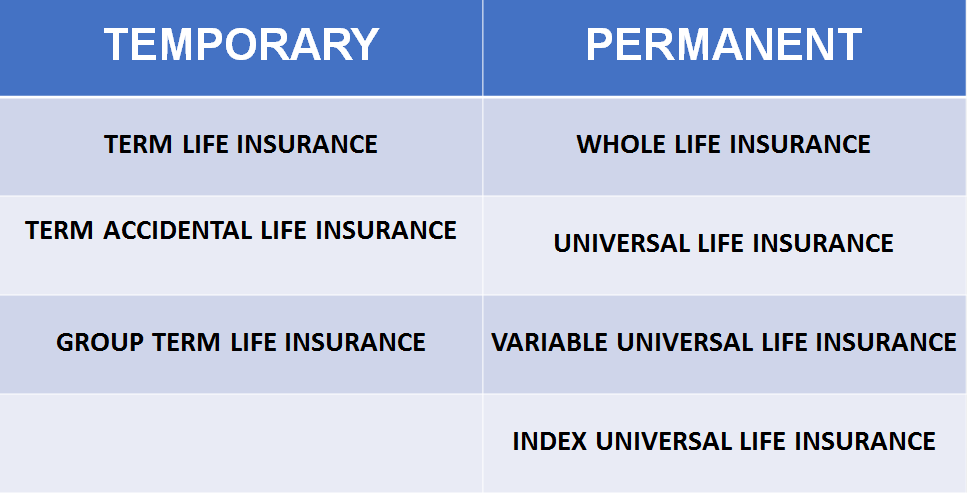

Do you have the right protection plan in place ??

Do you have the right protection plan in place ??

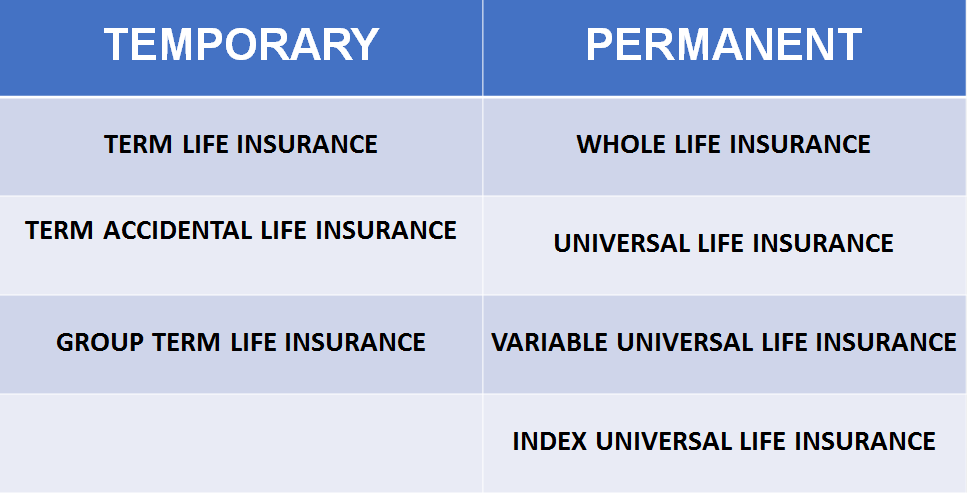

VS.

Permanent life

Group term life insurance is a type of term life insurance where the insurance company, or insurance broker, issues the employer a "group" contract with coverage extended to it's employees. It is commonly a component of a comprehensive benefits package offered by employers.

Accidental Death and Dismemberment Insurance, or AD&D Insurance, can provide financial benefits if you are killed; or lose a limb, suffer blindness, or are paralyzed in a covered accident.

Just as its name implies, an accidental death and dismemberment insurance policy covers death or injuries that are proven to be the direct result of a covered accident.

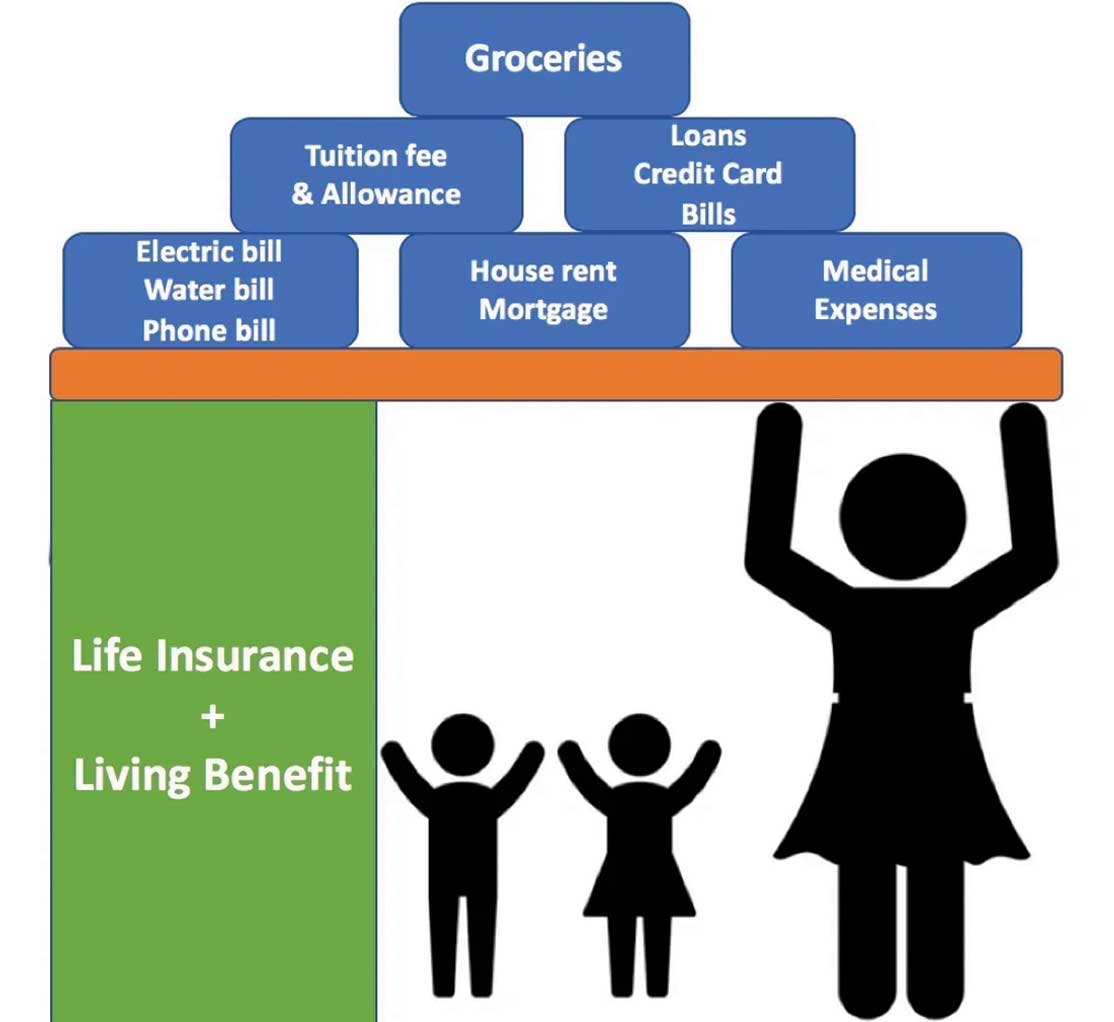

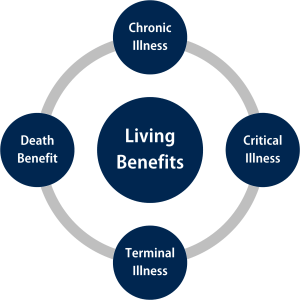

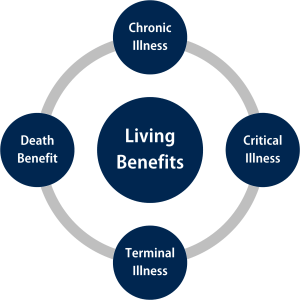

Living Benefits & Death Benefits of life insurance ?

The Death Benefit of a life insurance policy is the amount your loved ones (or others you designate as beneficiary) will receive from the insurance company upon your death. Some people think of life insurance only in terms of its death benefit, but there’s a flip side to some types of life insurance that’s fascinating…

The Living Benefits of life insurance allow the policy owner to access cash while still living. Here are beneficial use of both benefits:

- A good life insurance will provide insurance benefits as in both when the insured is living and when the insured dies.

- Death Benefit Protects families by providing benefits to survivors when a primary wage earner dies.

- Businesses use life insurance to protect against financial trauma of the company that can be caused by sudden death and serious illness of an business owner, partner of the company or important key employee.

- The money from a life insurance policy can be used to help families to cover expenses such as:

- Make down payment on a house or Pay off mortgage

- Use it as to provide a steady stream of supplemental income in retirement

- Permanent life insurance offers many tax advantages, including tax-deferred growth on cash value accumulation, tax-free access to your cash value, and income tax-free distribution of death benefits, under current tax law

- Tuition and sending children to college

- Vacation

- Often the benefits from a life insurance policy can keep a family from poverty and welfare

- Pay for medical bills and treatments to save insured’s life, Pay for care taker and Nursing homes

- Pay debt and often build wealth and leave family legacy

- Support continuous business operation despite of losing valuable physical and intellectual labor of a business

Group term life insurance is a type of term life insurance where the insurance company, or insurance broker, issues the employer a "group" contract with coverage extended to it's employees. It is commonly a component of a comprehensive benefits package offered by employers.

Accidental Death and Dismemberment Insurance, or AD&D Insurance, can provide financial benefits if you are killed; or lose a limb, suffer blindness, or are paralyzed in a covered accident.

Just as its name implies, an accidental death and dismemberment insurance policy covers death or injuries that are proven to be the direct result of a covered accident.

Is the type of Financial Protection Plan you will get lump sum money when you get sick, without worrying about yourself & your family’s financial situation.

Living Benefits & Death Benefits of life insurance?

The Death Benefit of a life insurance policy is the amount your loved ones (or others you designate as beneficiary) will receive from the insurance company upon your death. Some people think of life insurance only in terms of its death benefit, but there’s a flip side to some types of life insurance that’s fascinating…

The Living Benefits of life insurance allow the policy owner to access cash while still living. Here are beneficial use of both benefits:

- A good life insurance will provide insurance benefits as in both when the insured is living and when the insured dies.

- Death Benefit Protects families by providing benefits to survivors when a primary wage earner dies.

- Businesses use life insurance to protect against financial trauma of the company that can be caused by sudden death and serious illness of an business owner, partner of the company or important key employee.

- The money from a life insurance policy can be used to help families to cover expenses such as:

- Make down payment on a house or Pay off mortgage

- Use it as to provide a steady stream of supplemental income in retirement

- Permanent life insurance offers many tax advantages, including tax-deferred growth on cash value accumulation, tax-free access to your cash value, and income tax-free distribution of death benefits, under current tax law

- Tuition and sending children to college

- Vacation

- Often the benefits from a life insurance policy can keep a family from poverty and welfare

- Pay for medical bills and treatments to save insured’s life, Pay for care taker and Nursing homes

- Pay debt and often build wealth and leave family legacy

- Support continuous business operation despite of losing valuable physical and intellectual labor of a business

Do you have enough financial protection for your loved ones ?

LEARN MORE CONTACT US NOW APPLY NOW & SETUP MEETING

Do you have enough financial protection for your loved ones ?

LEARN MORE CONTACT US NOW APPLY NOW & SETUP MEETING

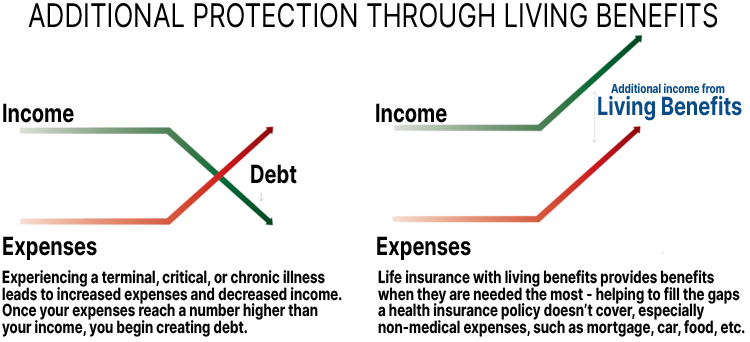

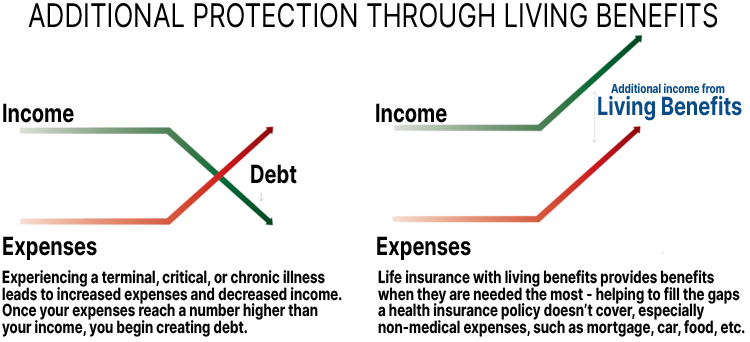

We call it: Life insurance you don’t have to die to use

You should have access to benefits you can use while you are living. You can access you policy’s benefits while you are still living. Your benefits may include coverage in case of a:

- Chronic illness

- Critical illness

- Terminal illness

You also have access to your policy’s cash value for events such as education, a down payment on a house, or retirement. You should have access to benefits you can use while you are living. We feel Living Benefits provide a combined solution that you can afford to have, but can not afford to be without. This unique package can help protect your plans for today and future.

We call it: Life insurance you don’t have to die to use. What does “life insurance you don’t have to die to use” mean to me? You can access you policy’s benefits while you are still living. Your benefits may include coverage in case of a, chronic illness, critical illness and terminal illness. You also have access to your policy’s cash value for events such as education, a down payment on a house, or retirement.

You should have access to benefits you can use while you are living. You can access you policy’s benefits while you are still living. Your benefits may include coverage in case of a:

- Chronic illness

- Critical illness

- Terminal illness

You also have access to your policy’s cash value for events such as education, a down payment on a house, or retirement. You should have access to benefits you can use while you are living. We feel Living Benefits provide a combined solution that you can afford to have, but can not afford to be without. This unique package can help protect your plans for today and future.

We call it: Life insurance you don’t have to die to use. What does “life insurance you don’t have to die to use” mean to me? You can access you policy’s benefits while you are still living. Your benefits may include coverage in case of a, chronic illness, critical illness and terminal illness. You also have access to your policy’s cash value for events such as education, a down payment on a house, or retirement.

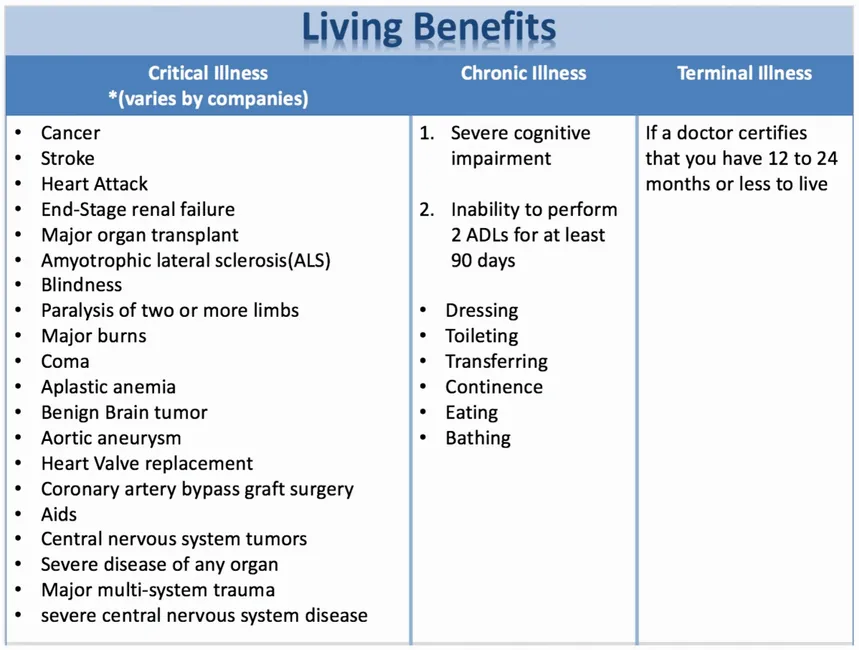

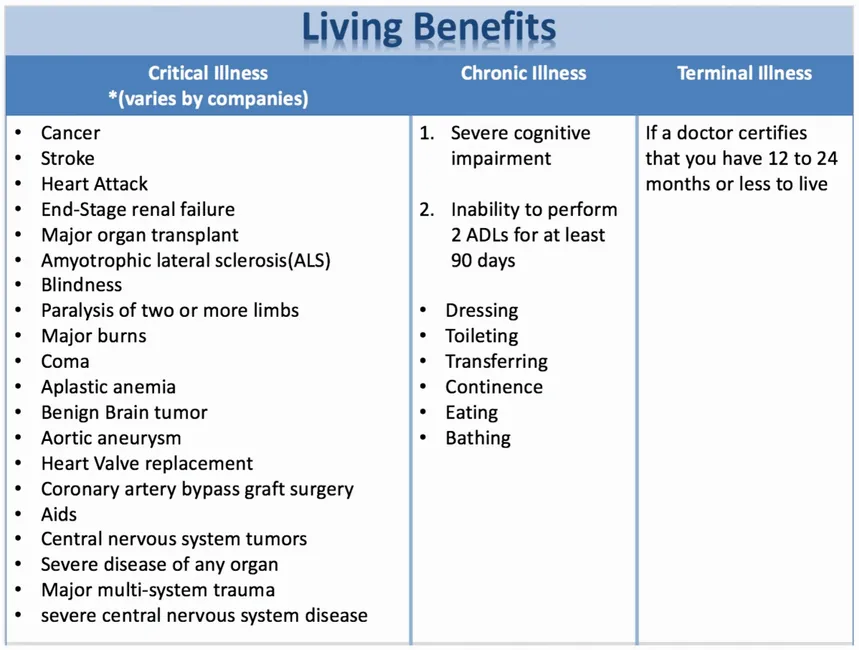

Chronic illness??!! (Please Refer to chart bellow)

Accelerated benefit for chronic illness.

May accelerate up to 25% of the policy’s death benefit if certified by a licensed health care practitioner in the previous 12 months *(varies by companies) as having a qualifying chronic illness. This rider does not terminate after the initial acceleration. Subsequent annual accelerations are available, upon continued qualification, until your client accelerates either 100% of the death benefit or the lifetime maximum of $1,000,000 *(varies by companies) Paid prior to death so amount paid will be less than the amount accelerated. May not be available in all states and is subject to underwriting requirements. Policy death benefit will be reduced by the amount accelerated.

The client should seek tax advice before exercising this rider.

Critical illness??!! (Please Refer to chart bellow)

Accelerated benefit for critical illness.

(varies by companies) You may access up to 100% of your policy’s death benefit, not to exceed $500,000, in the event you suffer a heart attack, stroke, or are diagnosed with cancer. This could help you in a variety of ways to pay for your financial matters as you focus on your treatment. The benefit amount for this rider will be based on your age and severity of the illness. The illness must first occur on or after the start date of the rider. Your death benefit will be reduced by the amount accelerated.

Terminal illness??!! (Please Refer to chart bellow)

Accelerated benefit for terminal illness.

If you are diagnosed with a terminal illness and not expected to live more than 24 months*(varies by states), this rider may accelerate up to 100% or less of the policy’s death benefit, not to exceed $1,000,000 *(varies by companies) The amount paid will be less than the amount accelerated, and your death benefit will be reduced by the amount accelerated.

These are some example of the riders *(varies by companies)

- Accelerated benefit for critical illness

- Accelerated benefit for chronic illness

- Accelerated benefit for terminal illness

- Waiver of monthly deductions if you are disabled

- Accidental death benefit rider

- Over loan protection rider

- Primary insured term life insurance rider

- Spouse term life insurance rider

- Children’s level term insurance rider

*(All living benefits are varies by companies & states rules & regulations)

Case Study

Nicholas, a husband and father of two, suffers a severe heart attack at the age of 54. He uses his critical illness rider to reduce the policy’s death benefit by $150,000, and in return gets $100,000 in cash today. He is able to use this money to cover his medical expenses, and pay of his family’s mortgage.

These are some example of the riders *(varies by companies)

- Accelerated benefit for critical illness

- Accelerated benefit for chronic illness

- Accelerated benefit for terminal illness

- Waiver of monthly deductions if you are disabled

- Accidental death benefit rider

- Over loan protection rider

- Primary insured term life insurance rider

- Spouse term life insurance rider

- Children’s level term insurance rider

*(All living benefits are varies by companies & states rules & regulations)

Case Study

Nicholas, a husband and father of two, suffers a severe heart attack at the age of 54. He uses his critical illness rider to reduce the policy’s death benefit by $150,000, and in return gets $100,000 in cash today. He is able to use this money to cover his medical expenses, and pay of his family’s mortgage.

Old one or new one ?

do you have?

Old one or new one?

Please Ask Questions

Living Benefit plan

LEARN MORE CONTACT US NOW APPLY NOW & SETUP MEETING

Please Ask Questions

Living Benefit plan

LEARN MORE CONTACT US NOW APPLY NOW & SETUP MEETING